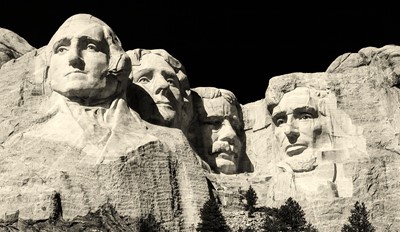

The United States elections. The real winner is…

How are you feeling about your investments right now?

Everything under control?

Do you have a sense of rising panic?

Is your adviser doing enough to stop the bleeding?

When is the current hiatus going to end?

All good questions. Let’s start with the first question from the top. Check your feelings on this. If you are feeling surprised at seeing your investment portfolio dropping, by between 5% and 10% since 1 January this year, perhaps you are new to investing? It might be the first fall in value you have experienced.

My advice is to talk with your adviser and get your apprehensions out in the open. What often happens, unless you are totally closed off, is that with a bit of fresh air your apprehensions go away. Fluctuations of around 10% happen quite often and are just the cost of investing. Relax, and breathe deeply.

All assets go up and down in value if you measure them often enough. If you valued your farm, or your business, or your family home on a minute-by-minute basis, every day, then you would find that they too go up and down in value with every little change in the environment. Interest rates are changing every day, willing buyers are coming and going, lots of things affect the prices of literally everything we own. We just don’t know it because we don’t worry about it. Perhaps there is a secret there for would-be panickers, don’t look. It’s the ‘I don’t worry about what I don’t know’ approach. It is a valid tactic employed by many investors.

They know and trust that their portfolio is designed to withstand the temporary fluctuations in value that come along, and they haven’t lost any money so long as they aren’t selling! What is to worry about?

If your objective is long-term, then stick to your long-term plan, otherwise you are just making yourself miserable for no good reason.

Markets are actually holding up very well at the moment given the mess the world is in. As usual our investments are dominated by what happens in America which has about half of the investable wealth in the world. America is still growing jobs and economic activity is holding up there despite the headwinds of Covid, disruptions to the supply of basic commodities, transport costs and a European war.

Everything under control?

Nothing is perfect, but spend some time enjoying the progress you have made over the past year or two. Accentuate the positive. There is likely to be a good news story there. We just don’t spend enough time reflecting and congratulating ourselves on the progress we have made. If you have investments in place but they have gone backwards, acknowledge the huge diversification you have, ready to enjoy the rewards when markets recover. You still own the same assets that you owned before the downturn and assets as a whole will continue to do their thing, producing goods and services for mankind. Nothing has changed there. Patience will be rewarded.

Accept that we can’t control everything, and we should only worry about the things we can control. Set yourself up so that the things you can’t control can’t wipe you out. I am talking about diversification here, the only free lunch we know of in finance.

Do you have a sense of rising panic?

We talked about this sort of feeling above. If you are new to investing, talk to someone. If you are an old hand, remember all the times you have felt like this before, been there, done that, and remember the rebound afterwards. If you are fully diversified, you have nothing to worry about.

Is your adviser doing enough to stop the bleeding?

One of our clients told us that “perhaps we had been asleep at the wheel” letting portfolios fall as they have over the past five months. Ouch, that hurt. In fact, we have a strategy that prevents us from reacting in hindsight to market movements. Reacting to what has already happened is chasing our tail and only ends in tears. Looking forward and anticipating what is about to happen can end up dead wrong too and is not worth the risk. You might get it right 9 times in a row, and think you are clever, only to crash on the tenth try. We have seen it time and time again.

Making changes to one’s investment strategy from time to time needs to be more than just a market reaction. There needs to be another reason for making a change, and one should consider what can possibly go wrong too.

When is the current hiatus going to end?

We don’t know when it will end, and it may get worse before it gets better.

Most investment portfolios are designed to weather the storms that come along from time to time with their wide diversification and with their allocation to bonds, although bonds are not creating the downside protection that they are meant to provide in this cycle.

Why are bonds not working to balance out falling share prices? It is because interest rates are rising at the same time as shares are falling. When interest rates rise, the value of existing bonds fall, to bring them into line with the new higher interest rates. The worst of both worlds. It has been a time to avoid bonds.

Is the ‘bond crisis’ over? Again, this involves forecasting, and nobody really knows. Be prepared for interest rates to keep rising for a while depressing bond values and wait for them to recover, which they will do at some stage.

This past year has been an exercise in how bonds do not work when interest rates are rising. Bonds only work as a supporting act when interest rates are level, or fall.

How have KiwiSaver investors fared with this latest downturn?

In the last downturn in March 2020 there were tens of thousands of KiwiSaver Growth fund members that converted to Conservative funds after their funds had turned down. All this did was to lock in their losses, and they had to watch from the side lines as their old Growth funds returned to their previous levels.

Over this latest downturn a couple of KiwiSaver fund managers’ report that –

Last time the FMA lambasted KiwiSaver fund managers for not providing the support for their members to resist the urge to bail from growth to conservative. Many of the fund managers have been trying harder to help their investors hold the line this time.

Whether you have a multi-million-dollar diversified portfolio, or $100,000 KiwiSaver portfolio, talk to an adviser before you throw the baby out with the bathwater and change your mix. It might only involve a 5-minute phone call but save you thousands.

Keep asking great questions...