The United States elections. The real winner is…

It's not unreasonable for people to have concerns about the unknown.

When we hear reports of issues like the Coronavirus (COVID-19) spreading, it's easy to feel uncomfortable about what might happen. Keeping yourself and your family safe is always the first priority. But what should you do regarding your investments? The answer is probably nothing.

Jared and Rhodes explain their thoughts on the subject in the video below.

Looking back to the last global virus of a comparable nature - SARS - might help provide a little context.

There are no definitive timelines for when SARS started and stopped, but broadly speaking the virus was responsible for the loss of life over an eight month period between November 2002 and July 2003.

It was certainly an unusual time. For anyone travelling overseas in that period, they may recall individual health screening at certain country's borders (Singapore in particular took highly precautionary measures). At the time most travelers felt unsettled about the environment around them, but even then, people continued to go on with their lives. Business and commerce still functioned.

Interestingly, our model portfolios performed well over that 8 month period. In spite of SARS and the increased global uncertainty surrounding it, our portfolios were up between 4% and 5% after fund management fees. By the end of the first 12 months since SARS was first observed, portfolios were up between 6.8% (a 20/80 portfolio) and 11.6% (a 98/2 portfolio).

While investors might have chosen to sell out of their investments due the early uncertainty, it would most likely have been a poor decision given the subsequent performance of the markets. In fact, if anything, the early uncertainty surrounding SARS created a buying opportunity as market volatility increased.

It may also be worth noting that SARS had a mortality rate of approximately 9.6%. How is this relevant? Well, perhaps it isn't, but the Coronavirus has a mortality rate currently hovering around 2% and doctors are predicting it will ultimately be less than 1%.

Whether that makes it less scary than SARS might be a moot point but, regardless, the markets treated investors fairly well through the SARS outbreak and there is no reason that the same won't happen through the Coronavirus outbreak as well.

As at February 27th, most of our model portfolios have been only modestly impacted by the increased market volatility experienced over the last week. Year to date, the approximate performances of our model portfolios range from +0.3% for our lowest risk portfolio (a 20/80 portfolio) to -7.0% for a 98/2 portfolio which has virtually all its assets allocated to higher risk assets. For many, a better indicator may be something closer to a balanced 50/50 portfolio which is currently showing a year to date return of -2.0%.

The media are doing their best to paint a picture that markets are crashing, but these sorts of returns, whether Coronavirus was an issue or not, are not out of the ordinary for portfolios containing allocations to higher risk assets.

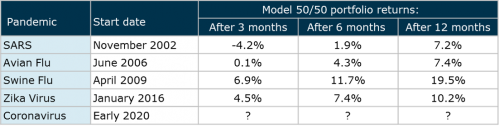

Of course, SARS isn't the only global health scare to have hit the headlines in the last 20 years. Even though it's a challenge - even in hindsight - to identify precisely when a pandemic officially starts or ends, it can often be useful to look back and observe how similar events in the past treated investors.

The following table highlights a few of the higher profile pandemics in recent history. We have identified an estimated start date for each of these pandemics (which, in most cases, is when they first began being widely reported in the public domain). We have then looked at the subsequent performance of a balanced 50/50 model portfolio (i.e. a portfolio with half of its funds allocated to risky assets) over the next three months, six months and 12 months.

The results may surprise you...

Within the first few months, the performance of markets and portfolios can be mixed. During SARS in particular, which was the first global pandemic to emerge in quite some time, the early reaction of equity markets was quite negative. During the Avian Flu outbreak a few years later, it was relatively flat. But what's even more striking is that within 6 and 12 months from the start of each of these outbreaks - regardless of their perceived severity - the performance of markets and the returns of model portfolios had generally all rebounded strongly. Note: Each time period relates to the time elapsed since the start date.

What will happen in the weeks ahead with respect to the Coronavirus outbreak?

The truth is that no-one knows. The markets today are really just reflecting the current heightened uncertainty in the form of lower prices. As soon as there is new information (good or bad) that will also get priced in. And when the tone of the news flow gradually changes from contagion to containment and, eventually, cure, then we should anticipate the improving risk outlook will be positive for risky assets which, this week especially, have come under increased pricing pressure.

The Coronavirus can be added to the list of issues that might make an investor think about selling but, as with all the other potential reasons on that list, our general response is that it's unlikely to be a good idea. Although we can't see into the future, we can observe the past, and in the other major pandemics we have witnessed in recent times, the best recommendation has always been to stay focused on the long term and maintain your strategy.

As always, if you have any concerns regarding your portfolio or other investments, please do get in touch with your adviser or any of the team at Polson Higgs Wealth Management.