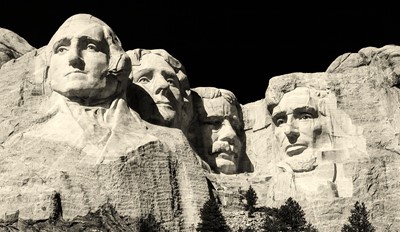

The United States elections. The real winner is…

Milton Friedman’s famous essay published in the New York Times in 1970 had the headline: The social responsibility of business is to increase its profits.

For half a century that phrase has been used in support of the notion that the role of the company is to maximise value for shareholders.

Since then, there has been wide international acceptance of Friedman’s doctrine of the primacy of shareholders although it has been widely eroded as well.

Margaret Blair, a corporate law and finance professor at Vanderbilt University in Nashville Tennessee, writes that "Milton Friedman’s shareholder credo is simple and catchy but has shaky foundations". She says:

In my limited education as a company director in New Zealand it has often been pointed out to me that the Companies Act of 1993 requires me to act "honestly, in the best interests of the company, and with reasonable care …" It does not mention that I must extract the most value for shareholders. It is to the company that I must focus my attention.

When I am asked to focus on the best interests of the company, I am sometimes confused about the term over which I am meant to be considering. What might be best over the short term may not be best for the company over the long term. The focus on shareholder value may put undue influence on short term considerations to the detriment of long-term company success.

Read Professor Blair’s article, Corporations Are Governance Mechanisms, Not Shareholder Toys published by the Chicago Booth School of Business.

In the same series, Friedman 50 years later, Martin Lipton also writes Beyond Friedman’s Doctrine: The True Purpose of the Business Corporation. It is not so easy to read as Blair’s essay, but it too supports a more eclectic version of capitalism, 50 years after Friedman.

Keep asking great questions …