- Home_

- Knowledge_

- When money personalities collide

When money personalities collide

“Should I splash out on that holiday or add a little more to savings?” One minute I’m convinced I deserve the experience, the next I’m worried about the financial future.

Ever had that internal tug-of-war? Money decisions can spark conflict not only between people but also within ourselves.

That’s because each of us has a distinct money personality; a set of preferences and instincts shaped by our upbringing, culture and experience. Sometimes it helps us make decisions with ease. Other times, it leads us into patterns that don’t always serve us well.

And when two different money personalities meet, whether in a couple, with family or among business partners, the difference can be even more pronounced. What feels like common sense to one person can seem reckless, joyless, or even irresponsible to the other.

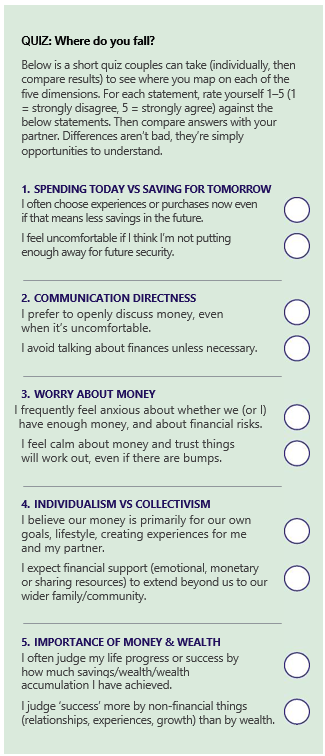

New research by social scientists has identified the five dimensions of money conflict. Knowing where you sit on each of them helps you understand your own tendencies. Knowing where someone else sits can help you identify where sparks might fly.

In this article, we explain the five dimensions, share examples and give you a quiz to see where your money personality aligns (and where it might collide with someone else’s).

The Five Dimensions

1. Spending today versus saving for tomorrow

Some people value living for today (i.e. travel, dining, experiences) while others focus on security through saving and risk avoidance. This clash can spark conflict: savers may see spenders as reckless, while spenders see savers as stingy. For example, one partner urges maximising retirement savings, while the other wants to buy a caravan to explore the country. The saver fears future regret; the spender resents deprioritising fun. Result... conflict.

2. Directness of communication about money

Some people speak openly about finances, income, debts and budgets. Others avoid it due to cultural norms or discomfort. This mismatch creates tension: direct communicators get frustrated by vagueness, while reserved ones feel pressured or judged. For instance, one spouse may want monthly reviews of every expense, while the other sees it as intrusive or joyless. As a result, financial decisions are delayed or unevenly managed.

3. Worry about money

Some people experience frequent anxiety about finances, worrying about emergencies, sufficiency or investment decisions. Others are more relaxed, trusting things will work out or paying less attention to financial risks. The worrier often sees the carefree partner as naive or careless, while the carefree one feels nagged or limited by constant concern. For example, the worrier may want a year’s emergency savings and extra insurance, while the other insists they already have enough and such caution is unnecessary.

4. Individualism versus collectivism in money

Some view money as personal, while others see it as a communal resource to support extended family or community, often shaped by culture. This difference can create conflict. One partner wants to help a struggling sibling, while the other believes self-reliance builds respect. The giver feels guilty withholding support; the other fears risking their own stability.

5. Importance placed on money and wealth

For some people, wealth is deeply tied to things such as identity, status and security. It’s not unusual to look at the balance of your account and almost feel like it’s a way of keeping score. If you see a big balance, it means that you’ve accomplished something, or the years of sacrifice were worth it. For others, the value of money lies not in having it, but in what it allows them to do.

Why we map differently

Money personalities aren’t random. They’re shaped by deep-rooted influences such as family upbringing, cultural values, life experiences and personal temperament. What looks like stinginess, carelessness or obsession is usually fear, world view, or habit.

These influences play out in different ways. For individuals, they can drive strong instincts - saving diligently, spending freely, or prioritising family obligations over personal goals. Without someone else to challenge those instincts, it’s easy to follow them unquestioned, which can lead to blind spots as well as strengths.

When two people come together, any differences can become pronounced. In a relationship, one partner may feel obliged to send money to struggling relatives, while the other fears that such obligations threaten their own security. Conflict arises not because one is wrong, but because each has different assumptions rooted in history and experience.

The way forward, for both individuals and couples, comes through communication and awareness. Recognising money patterns - your own and others’ - reduces judgment and builds empathy. Helpful steps include identifying where you sit on the key dimensions, reflecting on money influences and finding balance between caution and freedom. For couples it often helps to agree on when and how to discuss finances. For individuals, it can mean being intentional about reviewing your own habits.

In either case, a skilled adviser can add real value by helping to map money personalities, highlight blind spots and design a plan that aligns financial decisions with life goals.

Having a money personality is just part of being human. There’s no such thing as a right or wrong one but developing awareness of your own preferences and characteristics is something that all investors can benefit from.

related articles.