- Home_

- Knowledge_

- ‘Value’ investing is back, after a drought.

‘Value’ investing is back, after a drought.

Value investing is back with a vengeance.

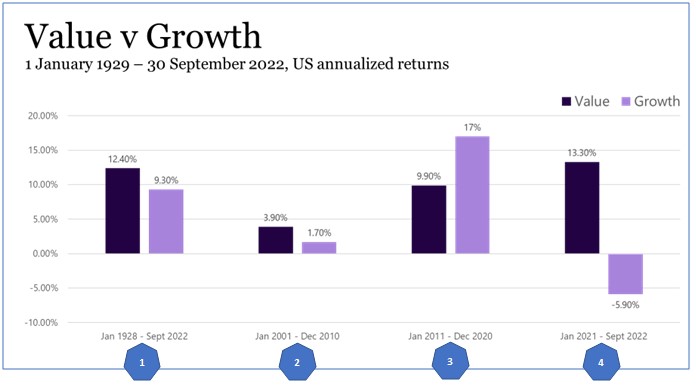

In the US share market, for the 21 months since January 2021, Value has out-performed Growth by 19.2% per annum.

A reminder what a Value company is – a company that is cheap compared to its assets. A Value company has perhaps been neglected by the market. It is not popular. And vice versa, a Growth company is expensive compared to its assets. Growth companies are typically popular companies where the price has been bid up compared to its assets.

The phwealth investment philosophy is based on scientific evidence supporting several style factors that demonstrate above-market investment returns over the long term. One of these style factors is ‘Value’. The evidence is that:

- Value companies out-perform Growth companies, on average, over the long term

But not every year!

Explanation of the chart above:

- For the 95 years of data in this bar chart, Value companies out-performed growth companies as a group by 3.1% per annum.

- For the ten years to the end of 2010, Value out-performed Growth by 2.2% per annum.

- For the next ten years to the end of 2020, Growth out-performed Value by 7.1% per annum.

- For the 21 months since January 2021, Value has out-performed Growth by 19.2% per annum.

What can we make of all this?

- As an investment house, we went a long time with an investment style that was out-of-favour during the ten years ending December 2020. Over this period our patience was sorely tested!

- We are not totally wedded to a Value-only strategy. Our investments include all types of companies, but we do over-weight Value companies at the expense of Growth companies.

- Out-performance from Value companies is random. There is no reliable set of conditions known to herald the superior returns from Value.

- Our patience has been rewarded.

Despite the ten-year period from Jan 2011 to Dec 2020 showing Growth beating Value, over the past 23 years Value beat Growth by 1.5% per annum compound, see below:

As you can see, the really poor performance of Value compared to growth occurred during the Covid crash in February/March 2020. Tech companies, which are typically Growth companies, became very popular during the lockdowns as they provided the tools for commerce to continue. This reversed over 2021 and 2022.

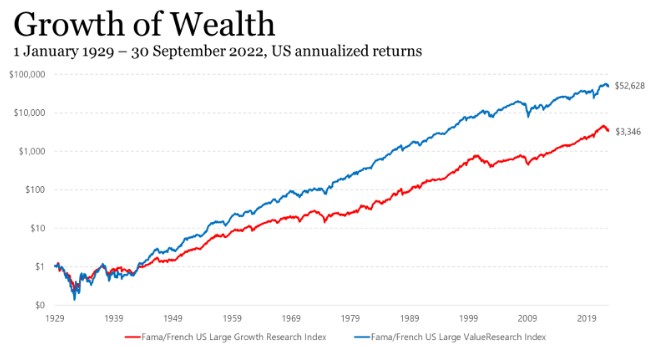

Over the very long term, we can see the compounding effect of the higher returns from Value in the graph below:

Over that time, $1 turned into $3,346 in large Growth companies while $1 turned into $52,628 in large Value companies.

Small Value companies have an even bigger edge, but that is for another time.

If you want to know more about our Value strategies, get in touch.

Keep asking great questions …