- Home_

- Knowledge_

- The United States elections. The real winner is…

The United States elections. The real winner is…

As we approach 5 November 2024, the date set for the US elections, the noise surrounding the two candidates will start to become deafening. It will be particularly loud on slow-news days when the media need to grab a sound bite to fill in the gaps.

No doubt there will be some headlines spouting off how Donald Trump might be better for the American economy, and therefore investment markets, while others speculate that the stability of Biden would be more favourable.

Do markets do better when a Democrat is President, or a Republican?

What impact will the US election result have on the global scene, and on New Zealand’s ability to trade with the US?

There is a kaleidoscope of moving factors at play here. For me, the key thing is that investment markets are incredibly efficient at pricing in the latest news to companies' share prices.

I remember when Donald Trump first got elected as President in 2016. I was at a networking event with a local law firm at a pool house in Dunedin. News started filtering thought that Trump was going to beat Hillary Clinton, which contravened what the polls were predicting. Some of the lawyers were into me about how bad it would be for their investment portfolios.

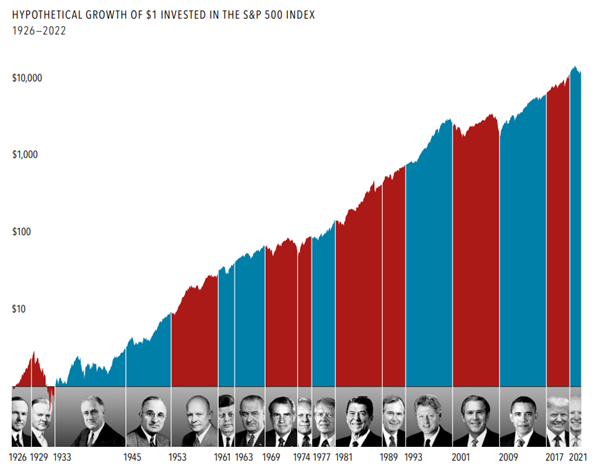

So, what did markets do during Donald Trump’s first presidential term? The American S&P500 index went up 63% over his 4-years in the hot seat. Before him, Barack Obama (Democrat) the S&P500 went up 81% in his first 4-year term, a total of 176% over Obama’s 8-year term as President. So far, the S&P500 is up 35% under Joe Biden (Democrat) with 7 months until the election.

Below is a graphic showing the long term rise of the S&P500 since 1926. The red shade represents a Republican President, the blue a Democrat President. As you can see, both Republicans and Democrats have had their fair share of success over the last 100 years with the American sharemarket!

An article in US magazine Money put it well:

“Conventional wisdom says a president’s economic policies matter greatly to Wall Street. But…. investors since the Great Depression have managed to make money in war and peace and under successful and failed administration”

To finish, many of our clients are invested in portfolios built to last 20 to 30 years. Over that time frame, both good times and bad times are a given. That is the nature of capitalism, which funds both worthwhile and worthless economic ventures.

History shows us that a globally diversified, low-cost portfolio is a ship that can and will survive the storms of politics, because it is founded on the success of business. Presidents come and go, but business in aggregate has never gone out of business, and won’t in the future, whatever president is elected in November.

So, we encourage you to relax, tune in to the news as an interest, but know that your long-term plans are based on something much more solid and stable than politics.

Keep asking great questions...