- Home_

- Knowledge_

- The man who helped us understand the pain of losing

The man who helped us understand the pain of losing

Recently we mourned the passing of a man who almost single handedly helped us make our clients better investors.

His name was Professor Daniel Kahneman, a Holocaust survivor, who won the Nobel Prize in Economics in 2002. But…. he wasn’t an economist. He was a behavioural psychologist. His insights have been summarised by the Washington Post this way, “He found that people rely on shortcuts that often lead them to make wrongheaded decisions that go against their own best interests.”

What does that mean exactly, and what does it have to do with investing?

Well, imagine that your bank emailed saying there was an error in their interest calculations, and they were depositing $20 into your account. How would you feel? You might be mildly happy.

But how would you feel if you got back to your car and saw a parking ticket that cost you $20? It’s likely that the parking ticket would feel far worse than the bank error in your favour made you feel good.

It was Daniel Kahneman that not only measured this phenomenon, but he gave it a name - “Loss Aversion”.

The question Kahneman helped answer is to what extent do equivalent losses hurt more than gains feel good? The answer is: losses feel between 2 and 3 times worse than equivalent gains.

Loss aversion is a mental shortcut. Everyone has it and without advice it generally results in investors acting against their own best interests.

As financial advisers we regularly live the reality of loss aversion. If a portfolio drops by 15%, we often hear from investors. When markets rise by 15%, no one calls us. The losses hurt, but the gains don’t produce the same reaction.

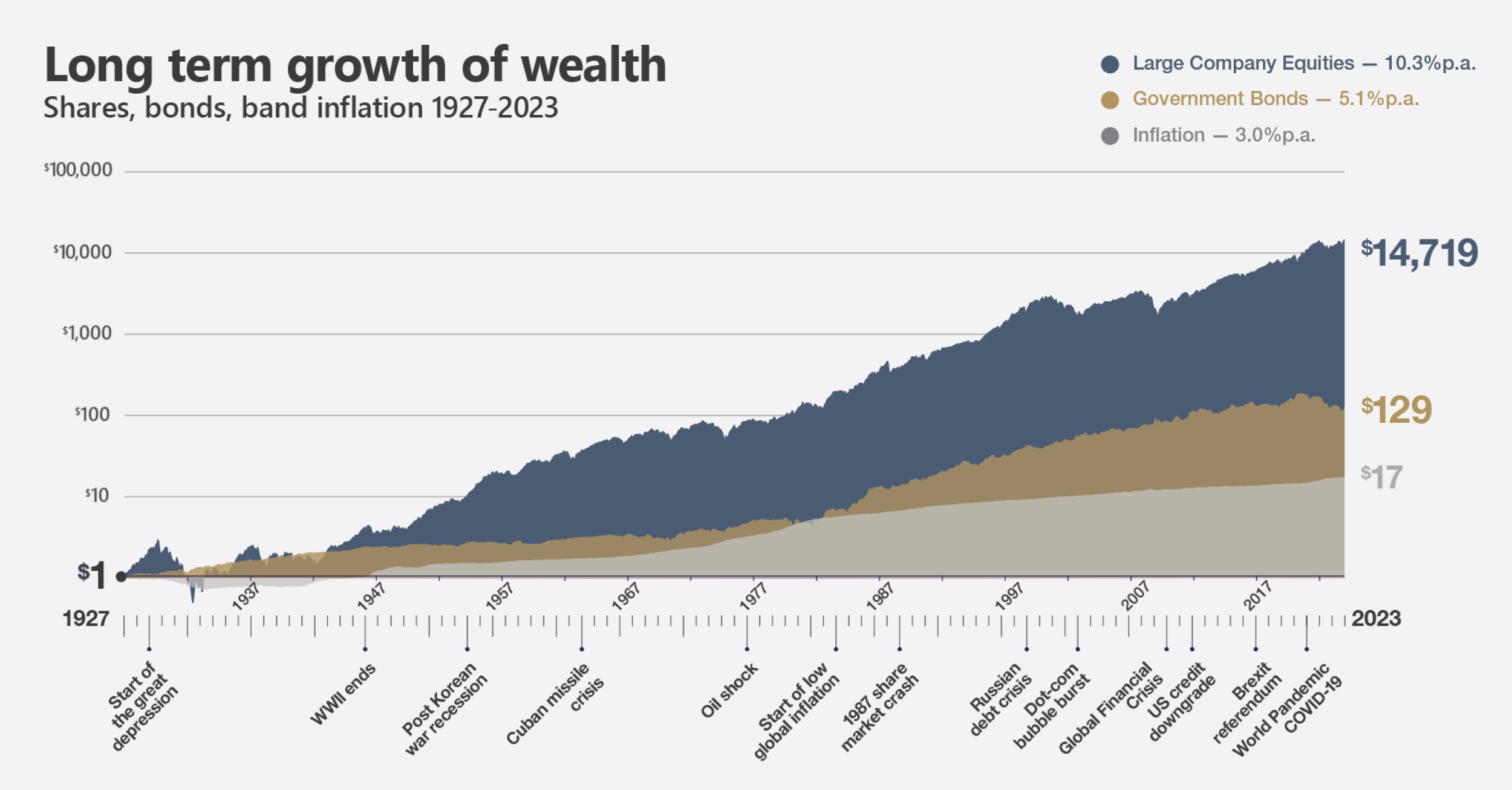

Over time, markets have gone up, and given enough time they’ve gone up substantially. In fact, looking at the gains over time in the chart below, where $1 invested in large company shares in 1927 turned into $14,719 by 2023, one really has to ask, “How could any investor mess this up?”

The biggest reason investors can mess this up is loss aversion. An example would be withdrawing an investment when faced with temporary losses.

The chart below summarises nearly 100 years of investing, but those little downward squiggles can be terrifying.

Countering loss aversion is so important that, to this day, we measure how sensitive clients are to potential losses and use that to guide our portfolio recommendations. We educate clients by showing them appropriate long-term data to encourage better decision-making when they are going to need it the most (i.e. when markets are going down).

Loss aversion affects investors in other ways. For example, let’s say that you come across someone that just purchased a lotto ticket for $1 and you offered to buy that ticket off them for $3. Now, with $3 they could purchase 3 more lotto tickets and triple their chance of winning. But when given this offer, what do you think will most lotto players do? That’s right, they’ll hold their ticket thank you very much. Why? Loss aversion. They know intuitively that if that ticket was the winner and they sold it, they would never forgive themselves. The ‘loss’ would be too high.

We often come across investors that hold a few poor ‘legacy’ investments including individual shares or properties. Do they want to sell them? No. But do they really want to keep them? Not really as they often have no strategic value. So, why not sell them? Because what if those shares go up after they sold? Loss aversion will often keep these investors holding something they shouldn’t, rather than investing in something they should.

Loss aversion is also responsible for the difficulty many have in setting goals.

Kahneman said, “Loss aversion refers to the relative strength of two motives: we are driven more strongly to avoid losses than to achieve gains. A reference point is sometimes the status quo, but it can also be a goal in the future: not achieving a goal is a loss, exceeding the goal is a gain.”

It’s true that a question many investors dread is “what are your financial goals?” One reason investors don’t like that question is that once you set a ‘goal’, you make achieving that goal the norm, or as Kahneman puts it, ‘the status quo’. You will only feel good if you achieve or exceed the goal. If you do worse than the goal, you’ll feel badly. The intuitive solution? Just don’t set goals or else set very short-term but less meaningful goals that you are likely to achieve. That way you can’t be disappointed.

Unfortunately, by not identifying clear financial goals, it often results in a lack of coherent financial strategy and predictably underwhelming results.

As we’ve highlighted here, a ‘loss’ can be many things and we have an aversion to all of them. But the most important and potent losses we come across are negative portfolio returns that occur during challenging down markets. But here’s the secret, articulated well by Ben Carlson, an adviser in the United States, “The ability to deal with losses is what separates successful investors from unsuccessful investors. You’re in trouble if losses cause you to overreact or make big mistakes at the worst possible moments. You cannot make it in the (share) market if you don’t have the ability to deal with losses on occasion.”

It’s our job to arm you with the information and confidence to deal with temporary financial losses.

We’re grateful for the brilliant insights offered by Professor Kahneman through his storied career. We’ve long thought it more important to create great investors than to select great investments. It’s our way of saying that investments should be boring, diversified, low cost, and do what they say on the tin. Speculating on the next great investment is a fool’s errand. But creating great investors, that’s something worth focusing on.

The single best way to create a great investor is to help them recognise their silent enemy – loss aversion. If they can understand and acknowledge it and be willing to work through the uncomfortable feelings it produces, it will dramatically improve their chances of achieving their future goals (there’s that word again!).

Daniel Kahneman has been in our corner for every part of that effort. We are thankful for him and confident his legacy will shine brightly for years to come.

If you have any interest in learning more about Daniel Kahneman and his brilliant insights into human behaviour, we recommend reading his book ‘Thinking Fast and Slow’. https://www.amazon.com.au/Thinking-Fast-Slow-Daniel-Kahneman/dp/0374533555.