- Home_

- Knowledge_

- The magic of the managed fund

The magic of the managed fund

Let’s talk about shares for a minute. No matter how you invest, there are really just two ways to make money from owning shares:

You receive a slice of the profits (called dividends), or

You sell your shares to someone else for more than you paid (that’s capital gain).

That’s it. Anything else is simply a different way of packaging those two outcomes.

And when it comes to owning shares, most people do it in one of two ways:

They buy individual shares, one by one, or

They invest in a managed fund, which owns the shares on their behalf.

Now, you’ve probably noticed we’re big fans of managed funds. It’s not because we can’t buy individual shares, we absolutely can and at very low cost. Thanks to efficient platform technology, we can buy and sell shares in markets like New Zealand, Australia, and the US for as little as 0.07%. That’s well below the 1% or more that some brokers might charge.

If buying shares directly is so inexpensive, why do we still prefer managed funds?

Let’s take a look at some numbers, starting with New Zealand.

Take the S&P/NZX 50 Index, which tracks the 50 largest companies on the NZ stock exchange. You can buy a fund that closely mirrors this index, or you can try to pick and choose among the individual companies the index contains.

So, which approach works better?

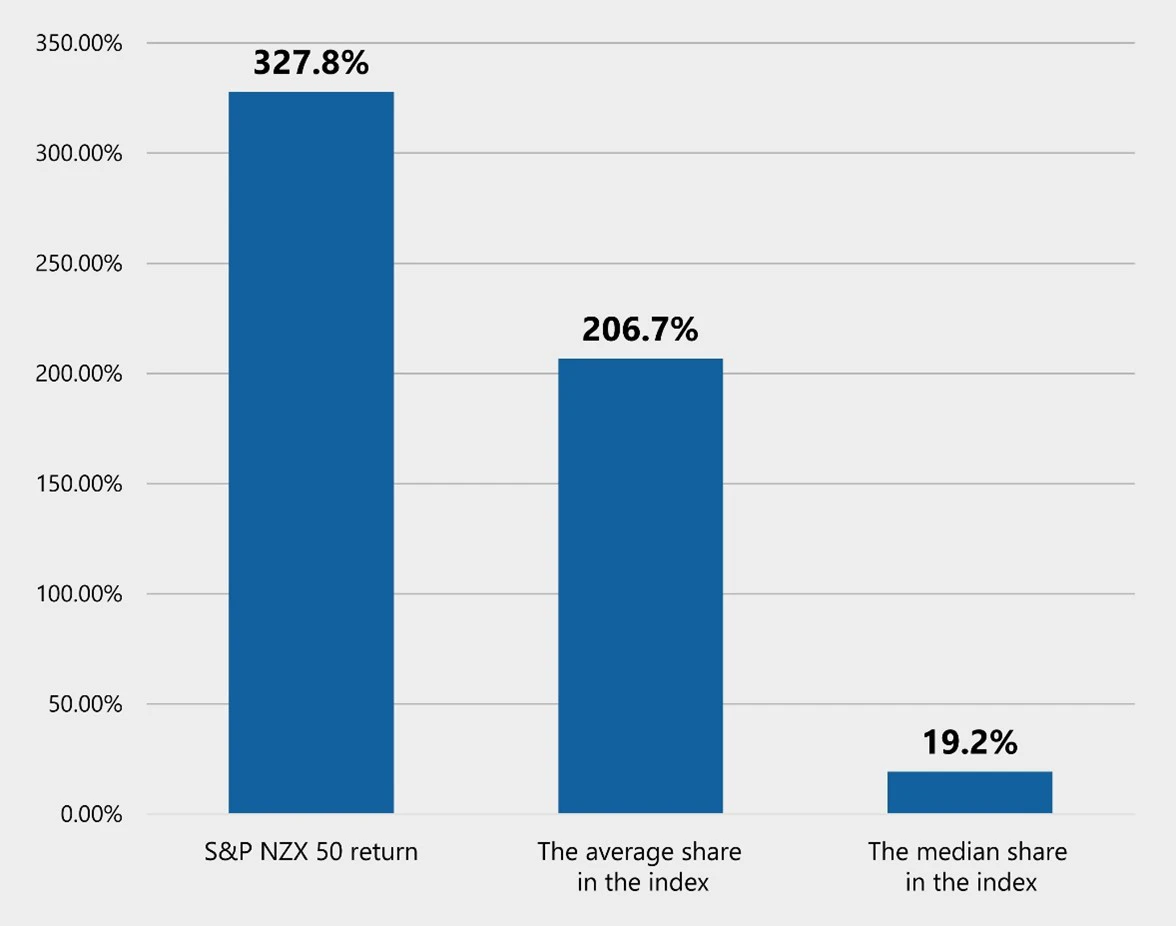

Over the past 20 years (to the end of 2024):

The index as a whole returned +327.8% - more than quadrupling in value.

The average company in the index returned +206.7%.

The median (middle) company returned just +19.2%. That’s barely ahead of inflation.

S&P NZX 50 cumulative returns 20 years ending 2024

Source: S&P Dow Jones Indices LLC, Bloomberg, Data from Dec 31, 2004, to Dec 31 2024.

Let that sink in.

The index outperformed the average, and the average outperformed the median. What does that tell us?

It means the index’s performance was driven by a relatively small number of superstar companies. When you own the full index (as you do with a fund), you automatically own the winners. You don’t have to guess which ones will deliver outsized returns, you capture them by default. That’s the real magic of owning a well-diversified fund: broad exposure to the upside without needing to predict the future.

You might be thinking, “Okay, but why not just buy the big winners ahead of time?”

Of course, everyone wants to own the next Fisher & Paykel before it takes off (and buying after the rise isn’t quite as effective). But here’s the problem: consistently picking those companies in advance is extremely difficult, even for professional fund managers.

Why? Because the odds are stacked against you.

Research by Hendrik Bessembinder (Arizona State University) found that over the long term, most individual shares underperform even super low-risk U.S. Treasury Bills. In fact, just 4% of all U.S. shares have accounted for nearly all of the wealth created in the U.S. share market since 1926.

In other words, unless you happen to pick that small handful of exceptional companies, chances are you’ll miss out on most of the market’s growth.

And it’s not just a New Zealand story. The same pattern shows up around the world. Over the past 20 years, the S&P 500 has risen by more than +600%, but most individual shares within it lagged far behind. Funds that matched the market did well because they held on to Amazon, Apple, Microsoft, and Nvidia all the way up.

There are many benefits to using well-constructed managed funds, but here are some of the key ones:

Global diversification – our portfolios hold over 8,000 companies across 40+ countries.

Operational simplicity – no need to worry about foreign exchange, new listings, corporate actions, or shareholder paperwork.

Efficient rebalancing – funds automatically adjust weights and holdings.

Low-cost access to scale – you get institutional-level pricing and execution.

Easy deposits and withdrawals – easy to invest or withdraw without needing to decide which specific shares to buy or sell.

Imagine trying to manage all that by yourself – buying thousands of companies, tracking currency movements, rebalancing monthly, processing dividends from dozens of markets. With managed funds, all of that’s taken care of, usually for a fraction of a percent per year.

So here’s the real point:

By using well-constructed managed funds, you:

Achieve broad diversification

Outperform most of the individual companies in the index

Avoid the high risk of over-allocating to individual companies that do poorly

Simplify your investing

Free yourself to focus on what matters more; your financial plan

It’s not just more convenient – it’s a smarter way to invest.

That’s the magic of the managed fund.