- Home_

- Disclosures & Policies_

- Service Disclosure Statement

service disclosure statement

and investment proposal.

Discretionary Investment Management Service

FSP 26381

Service Disclosure Statement

20 January 2026

1. What is this?

This is a discretionary investment management service (DIMS) provided by Polson Higgs Wealth Management Limited, trading as phwealth [us, we]. Under a DIMS, the provider invests your money on your behalf in financial products - such as managed funds invested in New Zealand and international shares, cash, and fixed interest investments - and charges fees for this service.

You will hold the financial products through a custodian. The types of investments that phwealth can invest your money in, and the costs, are described in the Investment Proposal section of this document from page 9.

You will be relying on the investment decisions that phwealth make. The value of the investments made for you may go up or down.

The provider of the DIMS is phwealth.

Polson Higgs Wealth Management Limited (FSP26381, trading as phwealth) holds a Financial Advice Provider (FAP) licence by the Financial Markets Authority to provide financial advice.

2. Who provides this service?

phwealth was founded in 2001. It has five Financial Advisers and five support staff across two offices:

Rhodes Donald, Co-CEO & Financial Adviser (Dunedin); Shiree Hembrow, Financial Adviser (Christchurch); Jared Campbell, Financial Adviser (Dunedin); Lisa Parata, Financial Adviser (Dunedin); Chris Asquith, Financial Adviser (Dunedin); Unicia Veer, Financial Adviser (Christchurch); Paul Wilson, Associate Adviser (Dunedin); Nicole Perry-Ellison, Associate Adviser (Dunedin); Brent Meffan, Operations Manager (Dunedin); and Chynal Prior, Marketing Administrator (Dunedin).

Dunedin

(Head Office)

139 Moray Place

Dunedin 9016

Christchurch

12/75 Peterborough Street

Christchurch 8013

The directors of phwealth are: Rhodes Donald (Co-CEO and Senior Adviser), Tim Dunn (Co-CEO of phwealth and a Director of Polson Higgs Ltd) and Stephen Higgs (Professional Director).

Who else is involved?

| Administrator | FNZ Limited | FNZ provides administration services for the Consilium platform used by the phwealth DIMS, meaning it holds, administers and reports on the investment portfolios managed on your behalf. FNZ has over $15 billion in funds under administration in New Zealand and over $640 billion globally. FNZ is one of New Zealand’s largest investment administrators. |

|---|---|---|

| Custodian | FNZ Custodians Limited | Investments are held in the name of FNZ Custodians Limited on your behalf. |

| Investment Consultant | Consilium NZ Limited | Consilium provides investment research and business support services to financial advisers, trustees and institutions throughout New Zealand. |

Neither phwealth, FNZ, Consilium nor any other person or entity named in this Service Disclosure Statement guarantee the financial products available through the DIMS.

3. How the phwealth DIMS works

Features of this service

The phwealth DIMS offers you access to investment portfolios that suit a range of investors’ needs and objectives. Under the service, you give phwealth the authority to make decisions as to which financial products to acquire or dispose of on your behalf, based on an agreed investment strategy.

To effectively manage your assets through their DIMS, phwealth must gain an understanding of your goals and objectives. We will spend time with you to understand what is important to you, and then design a specific set of investment recommendations aimed at achieving your goals.

A key concern for phwealth is to ensure that the portfolio constructed and maintained is suitable for you. Your financial situation, financial needs, financial goals, willingness to accept risk, and other requirements are all taken into account before a portfolio recommendation is made. This advice process involves a series of meetings, after which your Investment Authority can be confirmed, and your investment portfolio established.

From time to time we will check with you to ensure that we have an up to date understanding of your situation when considering the suitability of your portfolio. However, it is important that you let us know if anything changes, or if you have not told us about anything that might be relevant to the choice of portfolio. Our ability to match you with a portfolio to meet your requirements is only as good as the information you provide us with.

When deciding which investments to include in your portfolio, phwealth uses the research undertaken for us by Consilium.

The portfolio that your money will be invested in is described in the Investment Proposal section of this document.

Investment Portfolio Structure

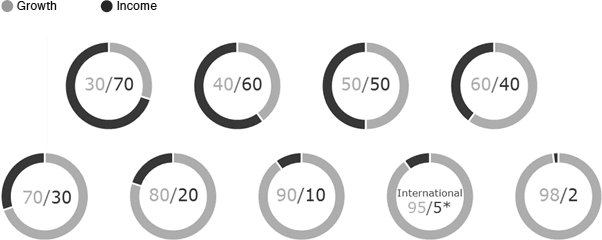

phwealth offers a suite of model investment portfolios. These portfolios have a range of growth and income investments in different combinations, and are designed to meet different investors' needs, risk profiles, investment terms and objectives.

phwealth’s portfolios are named on the basis of the split between growth investments (like shares and listed property) and defensive investments (like bonds and cash). Growth investments are generally considered more volatile and produce capital growth over time, whereas defensive investments are considered more stable, although they do go up and down in value with changing interest rates.

The 70/30 portfolio has a mix of 70% growth and 30% defensive investments. It is focused on investments that produce capital growth as opposed to stable investments, whereas the 90/10 portfolio has a mix of 90% growth and 10% defensive investments. This portfolio is almost exclusively focused on capital growth and its value will be volatile. The 50/50 portfolio has a balanced mix of both growth and defensive investments.

The model portfolios on offer as part of the phwealth DIMS are:

* The International portfolio is designed to exclude New Zealand investments for those clients who hold

New Zealand investments outside of the portfolio we manage.

A key concern for us is to ensure that the portfolio we construct and maintain is suitable for you. When we recommend a portfolio for you, we will take into account all you have told us about your financial situation, financial needs (including your required distributions), financial goals, tolerance for risk and other requirements. phwealth may, where it is appropriate, adapt a model portfolio to your individual situation.

Term Deposits

phwealth also offers a wholesale Term Deposit facility. These wholesale Term Deposits are available to clients who have a diversified investment portfolio (as above) with phwealth. Term Deposits are placed, via the custodian, with banks with a Standard and Poor’s credit rating of A– or better for terms of 12 months or longer.

Withdrawals

You can make one off withdrawals any time from your portfolio to your nominated bank account (see below). Simply communicate your requirements to us, either in writing or over the phone. We will always verify any instructions received by email or letter with a phone call to you. You can also make regular withdrawals – say, monthly, quarterly, or annually - from your portfolio.

Depending on the size of your withdrawal we may have to sell some of your investments and if so it can take up to 10 business days for you to receive your money.

Nominated Bank Account

As part of the process for opening a portfolio account with us, you are required to provide details of a bank account into which all withdrawals will be made. This is both a security measure for you and an anti-money laundering requirement. This is referred to as your Nominated Bank Account.

Reporting

We provide a comprehensive reporting programme so you can keep track of what is happening with your portfolio. This currently includes:

- Portfolio valuation reports and investment allocation statements

- Portfolio performance summaries

- Cash account and asset transaction summaries

- Income statements

- Fee schedule

- Annual tax statements (to IRD prepared formats)

Interim portfolio reports are also available at any time and can be accessed via the online portfolio portal by you at any time.

Procedure for Handling Funds

Investments held on your behalf are placed into the recommended investments through our Custodian.

phwealth does not directly handle your funds, but rather, acts as your agent to instruct the Custodian to acquire, hold and redeem investments on your behalf, on the terms described in this document. In doing so, phwealth makes whatever decisions it considers necessary or desirable to adequately maintain the portfolio structure you have selected. These decisions include (but are not limited to) the following transactions:

- Selling or purchasing individual investments

- Changing the weighting of various investment classes (whilst retaining the overall mix of growth and income investments you have selected)

- Making changes to the underlying investments, fund managers and/or funds within investment classes

Any withdrawals made from your portfolio go to your nominated bank account only.

The terms on which FNZ and FNZ Custodians Limited perform their roles are set out in an agreement between FNZ and Consilium NZ Limited (Consilium), to which phwealth has signed authority to enforce. That agreement also contains the terms on which Consilium can terminate the current custodial agreement. If Consilium terminates the current custodial agreement, Consilium in accord with phwealth would appoint a new custodian that we consider would meet its legal obligations, and the legal obligations of Consilium and phwealth, without interrupting the continuity of the phwealth DIMS. In this event, client portfolios would not be impacted.

Your Cash Management Account

Within your individual portfolio account at the custodian a separate cash account is established. All cash transactions relating to your portfolio flow through that cash management account.

Funds will be credited to your cash management account when:

- You make a deposit

- The investments held in your portfolio pay cash distributions (dividends or interest)

- Interest is credited on the balance of your cash management account

- Investments held in your portfolio are redeemed or manager rebates are received

Funds will be debited from your cash management account when:

- You make a withdrawal

- Fees and taxes are debited

- Investments are purchased

If necessary, phwealth will sell sufficient investments to top up your portfolio cash management account to meet the obligations payable from your cash management account as listed above.

How to Grant and Terminate the Investment Authority

To invest through the phwealth DIMS, you must sign our Client Agreement and Investment Authority. In doing so, you grant phwealth the authority to make all decisions in relation to the investment of your portfolio. The specific details of the authority you grant us are set out in the Investment Authority section of the Client Agreement.

Client Agreement

The Client Agreement that you sign when investing through phwealth governs your involvement in the DIMS. The law requires that you enter into a client agreement at the same time as or before your Investment Authority is granted.

On termination of your involvement in the phwealth DIMS the investments managed on your behalf will, at your discretion, either be transferred to another adviser and custodian of your choice, or sold and the cash paid into your nominated bank account. There is a risk on termination, where the full sale of investments has been selected by you, that market values are temporarily depressed and, all other things being equal, it would not be appropriate to sell the securities in that market. Some securities in your portfolio are not able to be advised on by unlicensed advisers, and there is the risk that these may have to be sold and reinvested by you elsewhere.

To terminate the Investment Authority, you must provide written and signed confirmation to phwealth giving us not less than 60 days notice. The vast majority of your funds, however, would be available within the expected 10-day period. The Client Agreement contains more detail on the termination process.

Your Rights and Powers Under This Service

When you invest through phwealth you are accessing a range of model portfolios, each managed for the benefit of a number of investors.

That means you:

- Have the right to expect your portfolio to maintain the board mix of growth to defensive investments that you chose in your Investment Authority.

- Are unable to give instructions to exercise rights over the financial products managed as part of your portfolio, such as rights to vote at shareholder meetings. Instead, these rights will be exercised by phwealth (through the custodian) on your behalf.

- Are unable to give instructions relating to the financial securities in your portfolio.

- Do not have the right to be consulted on, or to countermand, the investment decisions phwealth makes in relation to your portfolio.

You are always welcome to discuss the management or selection of your portfolio with us.

4. Risks of using this service

Investing through this service has risks. Under this service, you give up some control over investment decisions and rely on phwealth’s decisions.

All investments have a degree of risk. The value of your financial products may go down as well as up. You may not achieve the returns you expect and may not receive all your investment back.

When investing in any combination of bond, property and equity investments, investors are exposed to varying degrees of risk. For this reason, investment returns over any particular period cannot be guaranteed. For short or even extended periods, portfolio returns can be negative, so it is important that investors consider their risk tolerance, investment time frame and their understanding of investment markets before investing.

Below are the main risks that investors may be exposed to with our portfolios.

Regulatory Risk

There is the risk that future regulatory or taxation changes may affect the value of the securities held. phwealth keeps up to date with the prevailing regulatory and taxation environment in New Zealand and will discuss with you if any changes occur.

There is also the risk that the requirements for holding a DIMS licence may change, such that phwealth chooses to no longer offer their DIMS. If this situation were to arise, phwealth would still be able to manage your portfolio, although the way in which this was done would change.

Adviser Risk

The Investment Authority gives phwealth control over the decisions required to maintain your investment strategy. This means we have the ability to buy, sell or change investments in ways that might not align with the trades you would choose to make at that point in time. With that in mind, however, it is important to note that any trades phwealth makes will be in line with your investment strategy.

Administrator Risk

In the unlikely event that the administrator, FNZ Limited, was to become insolvent, your investments would not be affected as they are held by FNZ Custodians Limited, a bare trust. However the liquidity of your investments may be affected while the insolvency is being worked out.

Other Risks

The summary above is not intended to be comprehensive. Refer to section 4 in the Investment Proposal for more information.

There may also be risks that are unknown at the date of this disclosure statement that may affect investments at a future point in time. If these risks eventuate, investor portfolios could be adversely affected.

We will disclose to you any interest held by a phwealth representative or a related person who might influence the services that we provide to you. Where a conflict of interest that arises is such that we cannot place your interests ahead of our own interests, or the interests of any phwealth representative or related person, we may have to decline to act for you.

5. phwealth conflicts of interest

phwealth does not take brokerage or commission from the sale of investments within the phwealth DIMS..

The employees of phwealth invest via the phwealth DIMS alongside our clients. To this extent we have an interest, but our rationale is based on the investment philosophy, not on any obvious or direct gain we might receive.

phwealth has business relationships with fund managers and providers of services we outsource to. From time to time, our employees take part in conferences and professional development with these parties but always at phwealth’s expense other than occasional refreshments provided on the day.

All our financial advisers undergo annual training about managing conflicts of interest. We undertake a compliance assurance program, and a review of our compliance programme is undertaken annually by a reputable independent compliance consultant.

At the date of this document there are no benefits that phwealth, or any associated person, might receive that would or could reasonably be expected to materially influence our recommendations to acquire or dispose of any financial products or investment securities associated with the phwealth DIMS.

6. Tax

Taxes may affect your returns under this service. Your tax obligations will differ according to the nature of the investments and with your own circumstances. You are responsible for meeting any tax obligations that arise. You should seek professional advice on your tax obligations.

Resident withholding tax, PIE tax or other taxes may be deducted by the custodian or an issuer from portfolio returns.

Please note that all New Zealand investments apart from cash are held in PIE structures where investors are taxed at their PIE tax rate except for listed PIEs which are taxed only at 28%.

All the international investments in the DIMS are held as Australian unit trusts or exchange-traded funds and there is very little withholding tax deducted from this sector of your portfolio. The income from your international investments will need to be returned in your annual tax return and you will usually have further tax to pay.

You might as a result of investing in the phwealth DIMS be forced into the provisional tax regime if you are not a provisional taxpayer already.

7. How to complain

Our Feedback and Complaints Handling Process is published here on our website. Complaints should initially be made to your adviser, and/or to:

The CEO, phwealth, 139 Moray Place,Dunedin 9016

Phone: 03 474 9709

Email: help@phwealth.co.nz

If you are not satisfied with the internal complaints handling process outcome you can utilise phwealth’s external disputes resolution scheme run by Insurance & Financial Services Ombudsman Scheme Inc. (IFSO). No fee will be charged to any complainant to investigate or resolve a complaint through IFSO.

IFSO can be contacted at:

PO Box 10845, Wellington 6143

Phone: 0800 888 202

Email: info@ifso.nz

8. Where you can find more information

All the key information about phwealth and our DIMS service is contained or referred to in this Service Disclosure Statement and Investment Proposal, the Investment Authority and the Client Agreement.

We are required by law to provide you with quarterly and annual reports, which will be made available to you through the Custodian’s on-line platform (or by post should you not have access to the Internet). You may also request a copy of previous reports by contacting us. There is no charge for the provision of reports or for responding to requests for information about your investment portfolio.

Custodial Reporting

The independent custodian appointed by phwealth will regularly provide you with information about any money or property they hold on your behalf. This information will be sent by the Custodian directly to you.

This will include records of the balance of financial securities held and any cash and asset transactions effected for you by the custodian in respect of money or property held on your behalf. This information will be made available six-monthly by the Custodian through their on-line portal. If you do not register for the online portal we will post the reports to you.

You can request information by contacting your adviser or by emailing or writing to:

Administration

phwealth

139 Moray Place

Dunedin 9016

03 474 9709

help@phwealth.co.nz

9. How to enter into a client agreement

To join the phwealth DIMS you must:

- Sign the Client Agreement

- Sign the Investment Authority

- Satisfy Anti-Money Laundering requirements by providing proof of address, identification and your nominated bank account.

10. Contact Information

All enquiries can be made by contacting your adviser or:

Administration

phwealth

139 Moray Place

Dunedin 9016

03 474 9709

help@phwealth.co.nz

The custodian can be contacted at:

FNZ Custodians Limited

PO Box 396

Wellington 6140

04 803 9400

Investment Proposal

20 January 2026

1. Investment strategy

This Investment Proposal is provided separately to you by Polson Higgs Wealth Management Limited, trading as phwealth.

In summary, by signing an Investment Authority (provided separately) you give phwealth absolute discretion to invest your money in any securities and in any proportions phwealth determines appropriate so long as it fits within the broad mix between growth and income securities as agreed with you. The Investment Authority may only be changed by written agreement between you and phwealth.

phwealth offers investors a choice of model portfolios based on their preference for risk, expected return and their time horizon. There is also a suite of Socially Responsible Investment (SRI) portfolios for those wishing to invest ethically.

The nine model portfolio options effective at 11 July 2022 are described below. Percentage allocations are rounded to the nearest whole number.

| Classic Investment portfolio | Socially Responsible Investment portfolio | |

| 30/70 PORTFOLIO Allocation - 30% growth/70% income. Suitable for investors with a very short time horizon (2 to 3 years) before spending large amounts of their portfolio, or for those seeking a very low level of portfolio growth with a very low level of volatility. |

|

|

| 40/60 PORTFOLIO Allocation - 40% growth/60% income. Suitable for investors with a short time horizon (3 to 4 years) before spending large amounts of their portfolio, or for those seeking low portfolio growth with a low degree of volatility. |

|

|

| 50/50 PORTFOLIO Allocation - 50% growth/50% income. Suitable for investors with a moderate time horizon (4 to 5 years) before spending large amounts of their portfolio, or for those seeking moderate portfolio growth with a moderate level of volatility. |

|

|

| 60/40 PORTFOLIO Allocation - 60% growth/40% income. Suitable for investors with a moderate to long time horizon (5 to 6 years) before spending large amounts of their portfolio, or for those seeking moderate portfolio growth with a moderate level of volatility. |

|

|

| 70/30 PORTFOLIO Allocation - 70% growth/30% income. Suitable for investors with a long time horizon (7 years +) before spending large amounts of their portfolio, or for those seeking above average portfolio growth with a correspondingly higher volatility. |

|

|

| 80/20 PORTFOLIO Allocation - 80% growth/20% income. Suitable for investors with a very long time horizon (10 years +) before spending large amounts of their portfolio, or for those seeking above average portfolio growth with a correspondingly higher volatility. |

|

|

| 90/10 PORTFOLIO Allocation - 90% growth/10% income. Suitable for investors with a very long time horizon (10 years +) before spending large amounts of their portfolio, or for those seeking high portfolio growth with a correspondingly higher volatility. |

|

|

| 98/2 PORTFOLIO Allocation - 98% growth/2% income. Suitable for investors with a very long time horizon (10 years +) before spending large amounts of their portfolio, or for those seeking very high portfolio growth with a correspondingly very high volatility. |

|

|

|

Classic Investment Portfolio holdings |

Portfolio growth/income percentage |

|||||||||

|

Asset |

Country of origin |

Asset type |

30/70 |

40/60 |

50/50 |

60/40 |

70/30 |

80/20 |

90/10 |

98/2 |

|

Harbour NZ Index Shares Fund |

New Zealand |

Australasian equities |

7.5% |

9.5% |

11.5% |

13.5% |

15.0% |

15.0% |

15.0% |

15.0% |

|

Kernel NZ Small & Mid Cap Opportunities Fund |

New Zealand |

Australasian equities |

2.0% |

3.0% |

4.0% |

|||||

|

Dimensional Australian Core Equity Trust |

Australia |

Australasian equities |

2.5% |

3.5% |

||||||

|

Dimensional Australian Small Company Trust |

Australia |

Australasian equities |

2.0% |

2.0% |

2.5% |

3.0% |

3.5% |

4.0% |

||

|

Dimensional Australian Value Trust - Active ETF |

Australia |

Australasian equities |

2.5% |

3.5% |

4.0% |

4.5% |

5.0% |

5.5% |

||

|

Russell Investments Sustainable Hedged Global Shares Fund (NZD) (PIE) |

New Zealand |

International equities |

8.0% |

10.5% |

13.5% |

13.5% |

12.0% |

9.0% |

5.0% |

|

|

Russell Investments Sustainable Global Shares Fund |

New Zealand |

International equities |

2.0% |

2.0% |

||||||

|

Dimensional Global Core Equity Trust (NZD Hedged Class Units) |

Australia |

International equities |

2.5% |

7.5% |

13.0% |

20.0% |

28.0% |

|||

|

Evidential Sustainable Targeted Factor Fund |

New Zealand |

International equities |

10.0% |

14.5% |

18.5% |

22.5% |

25.5% |

29.0% |

32.5% |

34.0% |

|

Dimensional Emerging Markets Value Trust |

Australia |

International equities |

|

|

2.0% |

2.5% |

3.5% |

4.5% |

6.0% |

7.5% |

|

Harbour NZ Corporate Bond Fund |

New Zealand |

New Zealand fixed interest |

16.5% |

13.5% |

11.0% |

8.0% |

5.0% |

|

|

|

|

Dimensional 5-Year Diversified Fixed Interest Fund PIE |

Australia |

International fixed interest |

19.5% |

16.5% |

14.0% |

11.0% |

8.5% |

5.0% |

|

|

|

Dimensional 2-Year Sustainability Fixed Interest Fund PIE |

Australia |

International fixed interest |

22.0% |

15.5% |

8.0% |

4.0% |

|

|

|

|

|

Evidential Sustainable Global Bond Fund (NZD) |

New Zealand |

International fixed interest |

10.0% |

12.5% |

15.0% |

15.0% |

14.5% |

13.0% |

8.0% |

|

|

Cash |

New Zealand |

Cash & cash equivalents |

2.0% |

2.0% |

2.0% |

2.0% |

2.0% |

2.0% |

2.0% |

2.0% |

|

Total |

|

|

100% |

100% |

100% |

100% |

100% |

100% |

100% |

100% |

|

Socially Responsible Investment (SRI) Portfolio holdings |

Portfolio growth/income percentage |

|||||||||

|

Asset |

Country of origin |

Asset type |

30/70 |

40/60 |

50/50 |

60/40 |

70/30 |

80/20 |

90/10 |

98/2 |

|

Harbour Sustainable NZ Shares Fund |

New Zealand |

Australasian equities |

7.5% |

9.5% |

11.5% |

13.5% |

15.5% |

17.0% |

19.0% |

20.0% |

|

Dimensional Australian Sustainability Trust |

Australia |

Australasian equities |

2.5% |

3.5% |

4.5% |

6.0% |

7.0% |

8.0% |

9.0% |

10.0% |

|

Dimensional Global Sustainability PIE Fund (NZD) |

New Zealand |

International equities |

3.0% |

6.0% |

10.0% |

15.0% |

21.0% |

27.0% |

||

|

Evidential Sustainable Targeted Factor Fund |

New Zealand |

International equities |

10.0% |

13.5% |

17.0% |

20.5% |

24.0% |

27.5% |

30.5% |

33.5% |

|

Kernal Global ESG Fund (NZD) |

New Zealand |

International equities |

8.0% |

11.0% |

11.0% |

10.0% |

9.0% |

7.0% |

4.0% |

|

|

Dimensional Emerging Markets Sustainability Trust |

Australia |

International equities |

2.0% |

2.5% |

3.0% |

4.0% |

4.5% |

5.5% |

6.5% |

7.5% |

|

Harbour NZ Corporate Bond Fund |

New Zealand |

New Zealand fixed interest |

21.0% |

18.0% |

13.0% |

10.0% |

7.0% |

5.0% |

|

|

|

Dimensional 2-Year Sustainability Fixed Interest Fund PIE |

Australia |

International fixed interest |

29.0% |

22.0% |

17.0% |

10.0% |

4.0% |

|

|

|

|

Evidential Sustainable Global Bond Fund (NZD) |

New Zealand |

International fixed interest |

18.0% |

18.0% |

18.0% |

18.0% |

17.0% |

13.0% |

8.0% |

|

|

Cash |

New Zealand |

Cash & cash equivalents |

2.0% |

2.0% |

2.0% |

2.0% |

2.0% |

2.0% |

2.0% |

2.0% |

|

Total |

|

|

100% |

100% |

100% |

100% |

100% |

100% |

100% |

100% |

Investment Objectives of the Traditional Portfolios

The investment objective of each of the traditional portfolios is to perform to their respective benchmark containing the investment classes making up the portfolio, on a gross basis (before tax, fees and other expenses have been taken into account) over the time horizon for which the portfolio is suitable.

2. Historical performance of the investment strategy

The table below shows hypothetical returns for the classic and socially responsible portfolios that your investment strategy is based on (but does not reflect trading in actual accounts). It is based on a single hypothetical portfolio of $500,000 opened on 1 January 2020. Portfolio returns in these columns are net of estimated trading expenses (assuming annual rebalancing) but before all other fees and tax.

The data below is indicative of returns, but the actual returns experienced by investors in the future will vary depending on many factors, including:

- Exchange rates for the New Zealand dollar in the future

- Returns of the underlying investment classes and the securities used in the future

- New Zealand interest rates over the duration of your portfolio

- The timing and amount of cash flows into and out of the portfolio in the future

- The overall costs of transactions actually undertaken

- The timing and number of trades used to rebalance the portfolio

- The size of the portfolio, as larger portfolios have lower costs on a proportional basis.

Important

Hypothetical results have limitations. Hypothetical returns are only indicative of the actual trading performance. Because the portfolio includes trades that represent simulated historical performance and not actual trades, the results may have under-compensated or over-compensated for the impact of trading expenses and market factors like lack of liquidity.

Past returns (whether hypothetical or actual) do not tell you how the investment strategy will perform in the future.

Hypothetical returns on $500,000 after all costs but before tax

| Portfolio | 12 month return (1 Jan 2024 - 31 Dec 2024) |

5 year return (1 Jan 2020 - 31 Dec 2024) |

||

|

Classic Portfolio |

Socially Responsible Portfolio | Classic Portfolio | Socially Responsible Portfolio | |

| 30/70 |

10.0% |

10.1% |

4.2% |

4.3% |

| 40/60 |

11.4% |

11.6% |

5.0% |

5.2% |

| 50/50 |

12.5% |

13.0% |

5.8% |

6.1% |

| 60/40 |

13.8% |

14.4% |

6.7% |

6.9% |

| 70/30 |

15.1% |

15.8% |

7.5% |

7.7% |

| 80/20 |

16.4% |

17.3% |

8.2% |

8.6% |

| 90/10 |

17.9% |

18.7% |

9.2% |

9.5% |

| 98/2 |

19.0% |

20.0% |

9.8% |

10.3% |

Notes – Portfolio returns in these columns are net of estimated trading expenses (assuming annual rebalancing) but before all other fees and tax.

3. Fees and costs

There are fees associated with using phwealth’s services. These are deducted from your cash account. Where phwealth invests in managed funds, those funds have additional internal costs.

Total fees are made up of two main fee types:

- Advisory Service Fee

- Individual Action Fee

This information will be detailed in your regular portfolio reports.

Advisory Service Fee

Adviser fees are calculated on the daily balance based on the thresholds outlined in the following table. These fees are charged monthly to your cash account. GST applies.

| Portfolio size | Adviser fee (excl. GST) per annum |

|---|---|

| Up to $250,000 | 1.70% |

| $250,001 to $500,000 | 1.20% |

| $500,001 to $1,000,000 | 1.05% |

| $1,000,001 to $5,000,000 | 0.75% |

| $5,000,001 to $10,000,000 | 0.70% |

| $10,000,000 to $15,000,000 | 0.55% |

| $15,000,000 to $20,000,000 | 0.45% |

| $20,000,000 plus | 0.40% |

This means that, based on an example portfolio size of $750,000, an annual adviser fee of $9,875 would be payable to phwealth, plus GST at 8.4%.

FNZ Custodial fees

FNZ Custodial fees are calculated on the daily balance based on the thresholds outlined in the following table. These fees are charged monthly to your cash account. No GST applies.

| Portfolio size | Custodial fee (excl. GST) per annum |

|---|---|

| Up to $500,000 | 0.23% |

| $500,001 to $1,000,000 | 0.16% |

| $1,000,001 to $5,000,000 | 0.10% |

| $5,000,001 to $10,000,000 | 0.06% |

| $10,000,000 + | 0.05% |

This means that, based on an example portfolio size of $750,000, an annual fee of $1,650 would be payable for FNZ custodial services ($1,550 after 1 January 2025). This fee applies to the investment portion of the portfolio and is not charged on the cash balance.

Fees may be tax deductible for some clients. Please check with your accountant.

Total advisory service fee

This comprises the aggregate of the above-mentioned Advisory Service fee and FNZ Custodian fee calculated on a sliding scale relative to the size of the portfolio.

Fund management fees

Within the investment products used in the portfolio there are internal fund management costs which are paid to the fund manager. These costs are inherent within the investment product and are deducted from the funds and paid to the fund manager before the funds are valued. No GST applies.

| Fund | Fund management fee per annum |

|

Harbour NZ Index Shares Fund |

0.09% |

|

Harbour Sustainable NZ Shares Fund1 |

0.09% |

|

Kernel NZ Small & Mid Cap Opportunities Fund |

0.25% |

|

Dimensional Australian Core Equity Trust |

0.28% |

|

Dimensional Australian Small Company Trust |

0.55% |

|

Dimensional Australian Sustainability Trust1 |

0.28% |

|

Dimensional Australian Value Trust - Active ETF |

0.34% |

|

Russell Investments Sustainable Hedged Global Shares Fund (NZD) (PIE) 1 |

0.26% |

|

Russell Investments Sustainable Global Shares Fund1 |

0.24% |

|

Dimensional Global Core Equity Trust (NZD Hedged Class Units) |

0.30% |

|

Dimensional Global Sustainability PIE Fund (NZD)1 |

0.35% |

|

Evidential Sustainable Targeted Factor Fund1 |

0.59% |

|

Kernel Global ESG Fund (NZD)1 |

0.18% |

|

Dimensional Emerging Markets Sustainability Trust1 |

0.50% |

|

Dimensional Emerging Markets Value Trust |

0.60% |

|

Harbour NZ Corporate Bond Fund1 |

0.23% |

|

Dimensional 5-Year Diversified Fixed Interest Fund PIE |

0.28% |

|

Dimensional 2-Year Sustainability Fixed Interest Fund PIE |

0.25% |

|

Evidential Sustainable Global Bond Fund (NZD)1 |

0.32% |

Notes:

1 These funds are used in the Socially Responsible Investment portfolios only.

Individual Action fees

Transaction costs

When investment products are bought or sold as a result of a deposit, withdrawal, reinvestment, rebalance or any other reason, they may incur a transaction cost. In the table below, are outlined the current transaction costs incurred on the investment products currently forming part of the portfolio. These fees are payable directly to either the fund or to the broker, as applicable.

| Fund | Transaction costs buy/sell |

|

Harbour NZ Index Shares Fund |

Nil |

|

Harbour Sustainable NZ Shares Fund1 |

Nil |

|

Kernel NZ Small & Mid Cap Opportunities Fund |

Nil |

|

Dimensional Australian Core Equity Trust |

0.08%/0.08% |

|

Dimensional Australian Small Company Trust |

0.12%/0.12% |

|

Dimensional Australian Sustainability Trust1 |

0.08%/0.08% |

|

Dimensional Australian Value Trust - Active ETF |

0.08%/0.08% |

|

Russell Investments Sustainable Hedged Global Shares Fund (NZD)1 |

0.14%/0.12% |

|

Russell Investments Sustainable Global Shares Fund1 |

0.12%/0.10% |

|

Dimensional Global Core Equity Trust (NZD Hedged Class Units) |

0.10%/0.10% |

|

Dimensional Global Sustainability PIE Fund (NZD)1 |

0.10%/0.10% |

|

Evidential Sustainable Targeted Factor Fund1 |

0.15%/0.15% |

|

Kernel Global ESG Fund (NZD)1 |

Nil |

|

Dimensional Emerging Markets Sustainability Trust1 |

0.22%/0.22% |

|

Dimensional Emerging Markets Value Trust |

0.22%/0.22% |

|

Harbour NZ Corporate Bond Fund1 |

Nil |

|

Dimensional 5-Year Diversified Fixed Interest Fund PIE |

0.05%/0.05% |

|

Dimensional 2-Year Sustainability Fixed Interest Fund PIE |

0.05%/0.05% |

|

Evidential Sustainable Global Bond Fund (NZD)1 |

0.10%/0.10% |

| Cash |

Nil |

Notes:

1 These funds are used in the Socially Responsible Investment portfolios only.

A currency conversion fee will also apply if a conversion from one currency to another is required to buy securities, or if you instruct FNZ Limited to convert money from one currency to another. Information about this fee is contained in the FNZ Disclosure Statement, which your adviser can make available to you. The action fees will be deducted from your portfolio when the action occurs.

Administration fee

phwealth charges an administration fee as a contribution to the cost of establishing investments. No GST applies.

| Capital invested | Administration fee |

| Flat fee | $750 |

There are no further fees paid to phwealth for depositing additional funds or withdrawing from the portfolio.

Administration fees will be invoiced once a portfolio has been established and are due by the 20th of the month following.

The Fees Can Be Changed

Fees payable as part of phwealth DIMS are reviewed annually and are subject to change. You will be informed in writing if such a change is to occur as per your Client Agreement. Likewise, management fees and transaction costs are subject to change by the individual fund managers. Information regarding changes in management fees or transaction costs will be made available to you in regular reports.

Term Deposit Fees

If applicable, the wholesale Term Deposit fees are:

| Fee type | % per annum |

| Consilium Platform | 0.10% |

| Advisory service (phwealth) | 0.15% |

| Total | 0.25% |

4. Risk

Details of the risks of investing with phwealth are covered in Section 4 of the Service Disclosure Statement titled “Risks of using this service.” In this section we describe the volatility level, or up and down movements in value, that may be experienced by phwealth portfolios.

Standard deviation is a statistical measure that provides the portfolio’s average annual deviation from its long-term average return. A larger standard deviation means a portfolio’s returns in any one year are less certain and more volatile. According to statistical measures, about 68% of returns will fall within one standard deviation from the long-term average return.

Taking the 50/50 classic portfolio as an example, what this table shows is that the maximum annual gain experienced in any one year for portfolios of this type is 23.5%, while the maximum annual loss in any one year is –13.2% (over the 30 years to 31 December 2021).

Our expectation is that 68% of the time (roughly two years out of three) the annual return for this portfolio will fall within plus or minus 6.1% of its long-term average return.

| Portfolio | Annualised standard deviation |

Maximum historical annual gain |

Maximum historical annual loss |

|||

| Classic Portfolio1 |

Socially Responsible Portfolio2 |

Classic Portfolio1 |

Socially Responsible Portfolio2 |

Classic Portfolio1 |

Socially Responsible Portfolio2 |

|

| 30/70 |

4.1% |

4.3% |

16.7% |

20.1% |

-10.8% |

-12.9% |

| 40/60 |

5.1% |

5.2% |

20.0% |

22.3% |

-11.0% |

-13.1% |

| 50/50 |

6.2% |

6.2% |

23.6% |

24.5% |

-13.2% |

-15.4% |

| 60/40 |

7.4% |

7.3% |

27.6% |

26.7% |

-17.1% |

-19.5% |

| 70/30 |

8.5% |

8.5% |

31.8% |

29.3% |

-20.6% |

-23.6% |

| 80/20 |

9.7% |

9.7% |

37.0% |

34.5% |

-24.3% |

-27.6% |

| 90/10 |

10.9% |

10.9% |

42.4% |

39.9% |

-27.7% |

-31.5% |

| 98/2 |

11.9% |

12.0% |

47.0% |

44.5% |

-30.2% |

-34.6% |

Notes:

1 Analysis period for Standard Portfolios is January 1991 to December 2023

2 Analysis period for Standard Portfolios is January 1995 to December 2023

These numbers are based on hypothetical standard portfolios as at 31 December 2021 accurate to one decimal place. Past returns and volatility levels (whether hypothetical or actual) do not tell you how the investment strategy will perform in the future.

Some of the things that may cause your portfolio’s value to move up and down

Changes in global and/or domestic economic growth

Share values generally reflect an expectation about future growth. If these expectations change, share values will also change. In general, a drop in expected economic growth will mean a fall in investment values. At the same time, the reduction in expected economic growth may have the opposite effect on the fixed interest securities in your portfolio with fixed interest values increasing. In this way fixed interest, to the degree you have it in your portfolio, acts as a balancing mechanism to your listed property and shares.

Changes in the rate of inflation

Increases in the rate of inflation are built into expectations of investment values and growth. Over the long term, increases in the rate of inflation are likely to push up share values like they push up all prices, but the effect on investors' returns after inflation is uncertain. Increases in the rate of inflation above the target rate are likely to stimulate an increase in interest rates which decreases the value of fixed income securities. The opposite is also likely to be the case with a decrease in the rate of inflation below the target rate likely to stimulate a decrease in interest rates which would increase the values of fixed income securities.

Changes in investor sentiment

Prices will generally change if investors change their attitude towards accepting risk. The more risk investors as a group are willing to accept, the higher share values are likely to rise.

Changes in the real rate of interest

Increases in the real rate of interest will encourage share and fixed interest values to fall. Decreases in the real rate of interest will encourage share and fixed interest values to rise.

Fund manager risk

Investors are exposed to the investment style of the relevant fund manager of any managed fund investment, and to the risk that decisions made by the fund manager may not turn out positively. As the managed funds in your portfolio generally invest across a diversified range of countries and markets, with ‘best of breed’ managers appointed, this risk is minimised but cannot be avoided altogether. Growth oriented strategies would be more strongly affected by fund manager risk than income-oriented strategies.

Credit risk

If any investment in your portfolio becomes insolvent and is placed into receivership, liquidation or statutory management, or otherwise unable to meet its financial obligations in the form of interest or debt repayments, you may not recover the full amount of the investments made. Credit risk in phwealth's portfolios is significantly reduced within fixed income allocations by limiting exposures to investment grade securities only and by the wide range of diversification employed by the fund managers. A typical phwealth model portfolio has over 9,000 securities within it.

Changes in the value of the New Zealand dollar

phwealth invests in international shares and fixed interest. For shares, between 40 to 60% of the international exposure is hedged to the New Zealand dollar. If the NZ dollar rises, the value of hedged shares will be unaffected while the value of unhedged shares will fall. However, when the dollar falls in value, the value of hedged shares will be unaffected while the value of unhedged shares will rise.

This means that, compared to a portfolio that has none of its share exposure hedged, phwealth’s portfolios will do better while the New Zealand dollar is rising in value and will do worse while the New Zealand dollar is falling in value.

Changes in the risk premia for markets, small cap, value or profitability

phwealth’s approach is based on extensive academic evidence that, over long periods of time, relatively inexpensive (value) shares, small company shares and shares with higher gross profitability have higher expected returns. These additional returns, or premia, may not be realised during the term of your investment. This would result in returns being lower than those shown using historical data.

Loss of liquidity

All investment funds have the ability to temporarily suspend redemption from their funds during times of extreme loss of market liquidity where to not do so would disadvantage all investors in the fund.